Automated Currency Exchanges

04 Jul 2024I am happy to announce that after months of hard work, I have successfully implemented a service that creditors agents can install and run, which can perform automatic exchanges between gazillion of currencies, without using a “master” reserve currency.

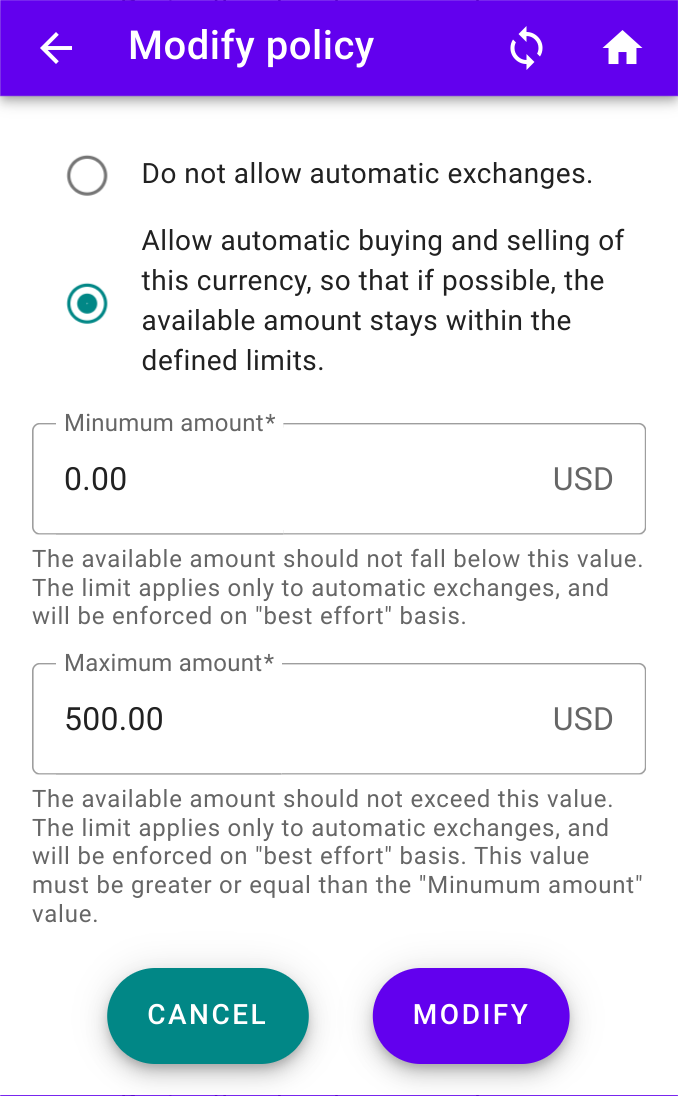

For quite some time now, the My wallet app has allowed users to set exchange policies for the currencies in their wallets, so that the creditors agent could arrange mutually beneficial currency exchanges between users:

But until very recently, this functionality has been missing on the backend, and all exchange policies set by users were ignored. Not anymore.

How does it work?

In a a previous post I explained that Swaptacular currencies can be pegged to other Swaptacular, and non-Swaptacular currencies, forming a “tree” of currency pegs.

Thus, the exchange rates between most Swaptacular currencies are known, fixed, and explicitly approved by currency holders. Therefore, the creditors agent knows:

- The fixed price of each currency. (This price is set by the issuer of the currency.)

- How much of each currency, each user is willing to sell.

- How much of each currency, each user is willing to buy.

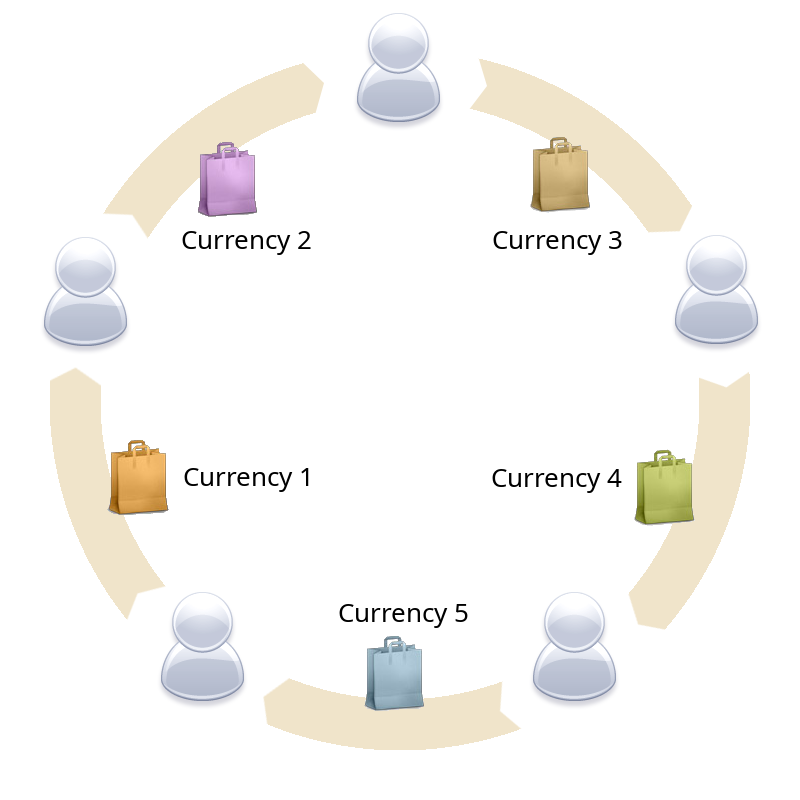

Having all this information makes the job of the creditors agent much easier, compared to traditional currency exchanges, where matching sellers’ and buyers’ prices is a major problem. In our case, we simply should look for possible circular trades:

If the picture above reminds you of the proverbial penny, which goes from hand to hand, in a circle, paying troublesome old debts — you are spot on. Here the idea is the same, but with several important generalizations:

-

The circular trades are found automatically, using a relatively simple algorithm. The number of participants in each circular trade can be very big, but can also be as small as 2.

-

We can clear debts accumulated not in one, but in many different currencies.

-

In addition to paying old debts, each circular trade can also create new debts.

Note that this point is very important: In Swaptacular, creating new debt and issuing new money in circulation is actually the same thing. Also, paying old debts is the same as taking money out of circulation. Therefore, we need to constantly do both.

The crux of the matter here is that circular trades are always arranged according to the exchange polices set by the currency holders. Thus, every automatically arranged circular trade is, by design, beneficial for all of the participants.

What’s in it for the creditors agent?

We know that the creditors agent’s job is to maintain the infrastructure of servers which enables currency holders (aka creditors) to trade, and make payments in gazillion of different currencies. It is only fair that there should be some reward for this!

For every circular trade that the creditors agent arranges, a small portion of the traded amounts will be retained as a reward. Thus, as time passes, the creditors agent will end up holding some amounts of a huge number of different currencies. Fortunately, the creditors agent can use its own “automated currency exchanges” services, to trade the currencies that it does not need, for currencies that it does need. This process has not been automated yet, but I have plans to automate it in the future.